Passive Income Playbook: How I Built a Smarter Financial Plan That Actually Works

You’ve probably heard the phrase “make money while you sleep,” but what does that really mean for someone like you trying to build real financial stability? I started from scratch—no inheritance, no lottery win—and discovered how to create steady passive income streams through smart, realistic planning. It’s not about get-rich-quick schemes; it’s about strategy, patience, and making your money work for you. This is the journey I took, and how you can start shaping your own future too. Financial freedom isn’t reserved for the wealthy or well-connected. It’s achievable through deliberate choices, consistent effort, and a clear understanding of how money grows over time. This playbook outlines the steps I followed, the mistakes I made, and the principles that helped me turn ordinary income into lasting wealth.

The Wake-Up Call: Why Relying on a Paycheck Isn’t Enough

For years, I believed that working hard and receiving a steady paycheck would eventually lead to financial security. I climbed the career ladder, earned promotions, and watched my income rise. Yet, despite all that progress, I found myself living paycheck to paycheck, with little room for unexpected expenses. That changed when my car broke down and I had to cover a $1,200 repair bill. I realized I didn’t have enough in savings to handle it without using a credit card. That moment was a wake-up call: no matter how much I earned, if all my income depended on my time, I was one emergency away from financial stress.

Active income—money earned in exchange for time—has a ceiling. You can only work so many hours in a day, and your earning potential is limited by your job, industry, and geography. Even high salaries don’t guarantee long-term security if there’s no plan to grow wealth beyond the paycheck. I began to see that financial freedom wasn’t about earning more; it was about earning differently. The real goal wasn’t to trade more hours for more money, but to build systems that generate income regardless of whether I was actively working. This shift in mindset was the first step toward creating a sustainable financial future.

Passive income offers a way to break free from the time-for-money cycle. While it requires effort upfront, the long-term benefit is the ability to earn without constant labor. For many people, especially those managing households, caregiving, or balancing multiple responsibilities, this flexibility is invaluable. It’s not about quitting work or avoiding effort—it’s about designing a financial life where money continues to grow even during life’s busiest or most unpredictable moments. That’s why relying solely on a paycheck, no matter how reliable, is not enough to achieve lasting financial peace.

What Is Passive Income—And What It’s Not

There’s a common misconception that passive income means earning money with zero effort. Advertisements often promise “set-it-and-forget-it” systems that generate thousands with no work. The truth is far more realistic: passive income usually involves significant upfront work, careful planning, and occasional maintenance. I learned this lesson after investing in a rental property I believed would run itself. I quickly discovered that tenant issues, repairs, and local regulations required ongoing attention. While the income was passive compared to a job, it wasn’t effortless. Understanding this distinction is crucial to building realistic expectations and avoiding costly mistakes.

True passive income comes from assets that generate returns over time with minimal active involvement. Examples include dividend-paying stocks, interest from bonds or savings accounts, rental income from real estate, and royalties from creative work like books or music. Each of these requires initial investment—whether financial, time, or both. For instance, writing an e-book takes weeks of effort, but once published, it can earn royalties for years. Similarly, buying a rental property involves research, financing, and setup, but can provide monthly cash flow long after the initial work is done. The key is that the effort is front-loaded, not ongoing.

Not all so-called passive income opportunities are equal. Some carry hidden risks or require more management than advertised. Peer-to-peer lending, for example, may offer high returns, but defaults can wipe out gains. Similarly, automated online businesses often require constant updates, customer service, or marketing to stay profitable. I now evaluate any passive income idea by asking three questions: What is the upfront cost? How much ongoing effort is required? And what are the real risks? This helps separate sustainable options from those that are overhyped or unsustainable. Passive income isn’t magic—it’s a strategy built on preparation and informed choices.

Building the Foundation: Financial Planning That Supports Passive Growth

Before I could build passive income streams, I had to fix my financial foundation. I used to think investing was the first step toward wealth, but I was wrong. Without a stable base, even the best investments can fail. My turning point came when I started tracking every dollar I earned and spent. I discovered I was spending nearly 30% of my income on subscriptions I rarely used and dining out more than I realized. By creating a realistic budget, I freed up hundreds each month—money I could use to build savings and invest.

One of the most important steps was paying down high-interest debt. I had two credit cards with rates over 19%, and the minimum payments were eating into my ability to save. I used the debt snowball method, focusing on the smallest balance first to build momentum. As each debt disappeared, I redirected that payment toward the next one. Within 18 months, I was debt-free. That relief allowed me to shift from survival mode to growth mode. Suddenly, I wasn’t just avoiding financial stress—I was creating space to build wealth.

Another critical piece was building an emergency fund. I started with a goal of $1,000, then gradually increased it to cover three to six months of essential expenses. This fund became my financial safety net. When my furnace failed in winter, I didn’t panic or go into debt—I paid for the repair without disrupting my long-term plans. With a strong foundation in place, I could finally start investing with confidence. Budgeting, debt control, and emergency savings aren’t glamorous, but they’re the bedrock of any successful financial strategy. Without them, passive income efforts are built on shaky ground.

Smart Assets: Choosing Income-Generating Investments with Balance

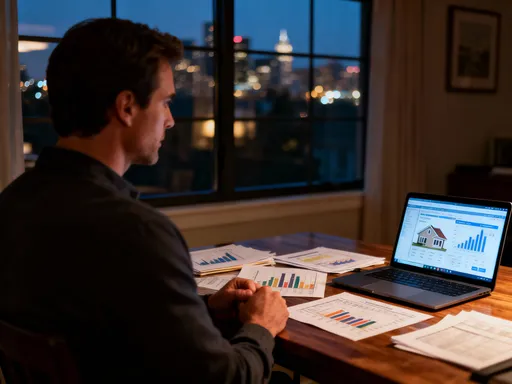

Once my finances were stable, I began exploring income-generating investments. My goal wasn’t to chase the highest returns but to build a balanced portfolio that could grow steadily over time. I started with dividend-paying stocks because they offered both income and the potential for long-term appreciation. I focused on companies with a history of consistent dividend payments and strong financial health. These weren’t flashy tech startups promising explosive growth, but established businesses in sectors like utilities, consumer goods, and healthcare. Over time, the regular payouts provided a reliable stream of passive income.

I also explored real estate investment trusts (REITs) as a way to gain exposure to property without buying physical buildings. REITs are companies that own or finance income-producing real estate and are required to distribute at least 90% of their taxable income to shareholders. This structure makes them a strong source of dividends. I chose REITs focused on residential and healthcare properties, which tend to have stable demand. By investing in a diversified REIT fund, I reduced the risk of relying on a single property or location. The income wasn’t as high as some private real estate deals, but it was far more manageable and required less hands-on work.

Peer lending was another option I tested, but with caution. I allocated only a small portion of my portfolio to this asset class because of the higher risk of borrower defaults. I spread my investments across dozens of loans to minimize the impact of any single failure. While the returns were attractive initially, I found the process more time-consuming than expected and eventually reduced my exposure. This experience taught me that yield quality matters more than yield size. A 6% return from a stable, well-diversified investment is more valuable than an 8% return from a risky one that could lose principal. Reinvesting early gains also played a key role. By using dividends to buy more shares, I took advantage of compounding, which accelerated my wealth growth over time.

Risk Control: Protecting Your Income Without Overcomplicating It

Risk is an unavoidable part of investing, but it doesn’t have to be overwhelming. I learned this after losing money on an investment I didn’t fully understand. I was drawn to a high-yield bond fund promising 7% annual returns, but when interest rates rose, the value of the bonds dropped sharply. I sold in panic and locked in the loss. That experience taught me that chasing returns without understanding the risks is a recipe for failure. Now, I prioritize risk assessment just as much as return potential. Every investment I consider goes through a simple checklist: What could go wrong? How much could I lose? And can I afford that loss without derailing my goals?

Diversification is my primary tool for managing risk. Instead of putting all my money into one asset or sector, I spread it across different types of investments. This means owning a mix of stocks, bonds, real estate, and cash equivalents. When one area underperforms, others may hold steady or even gain, reducing the overall impact on my portfolio. I also diversify within asset classes—owning stocks from different industries and countries, for example. This approach doesn’t eliminate risk, but it reduces the chance that a single event will wipe out my progress.

Understanding market cycles is another key part of risk control. Markets go up and down, and trying to time them perfectly is nearly impossible. Instead of reacting to every dip or surge, I focus on long-term trends and stay invested through volatility. I avoid emotional decisions by setting clear rules for buying and selling. For instance, I don’t sell just because the market drops 10%—I review my portfolio only at scheduled times, like quarterly. This discipline helps me stay on track. I also build buffers into my plan, such as keeping some cash in reserve and maintaining low debt. These safeguards ensure that a single setback won’t force me to make desperate financial choices.

Real Skills, Real Gains: Using Side Efforts to Fuel Passive Streams

Some of my most successful passive income streams started with active work. I realized that my knowledge and experience could be turned into assets that keep earning over time. I had spent years managing household budgets, planning meals, and organizing family schedules. I decided to share that expertise by creating a digital course on practical home finance for busy families. The first version took months to develop—writing content, recording videos, designing worksheets. But once it was live, it began generating sales with minimal ongoing effort.

The course wasn’t an overnight success. It took consistent marketing, customer feedback, and small improvements to gain traction. But over time, it became a reliable source of income. I automated the delivery process using a secure platform, so new buyers get instant access without my involvement. I also added upsells, like printable budget templates and a monthly newsletter, which increased the value and revenue per customer. This experience showed me that passive income doesn’t have to come from traditional investments—it can come from packaging your skills into products that scale.

Other creative assets followed. I wrote an e-book on meal planning that sells on multiple online platforms. I licensed some of my original content to educational websites, earning royalties without additional work. Each of these projects required effort upfront, but now they generate income while I focus on other priorities. The key was starting small, validating the idea with real users, and improving over time. For anyone with knowledge, creativity, or experience, there’s potential to build similar streams. It’s not about being an expert—it’s about sharing what you know in a way that helps others and creates lasting value.

Staying on Track: Habits That Keep Your Plan Alive Long-Term

Building passive income isn’t a one-time project—it’s an ongoing process. I used to jump from one strategy to another, chasing trends like cryptocurrency or hot stocks. Each shift disrupted my progress and cost me time and money. Now, I follow a simple but powerful rule: consistency beats intensity. I review my financial plan every quarter, assess performance, and make adjustments based on life changes. This regular check-in keeps me aligned with my goals without reacting to short-term noise.

Patience is another essential habit. Wealth building takes time, and there are no shortcuts. I remind myself that small, steady gains compound into significant results over years. I don’t measure success by monthly account statements but by long-term progress toward financial independence. Discipline plays a big role too. I automate savings and investments so they happen before I even see the money. This removes temptation and ensures I stay on track, even during busy or stressful times.

Staying informed is important, but I avoid obsession. I read trusted financial sources and listen to expert insights, but I don’t check my portfolio daily or react to every market headline. This balance helps me make thoughtful decisions without falling into anxiety or overtrading. Financial freedom isn’t a destination I’ll reach and then stop—it’s a mindset of continuous learning, adjustment, and growth. By focusing on sustainable habits, I’ve built a plan that works for my life, not against it. And that’s the real power of passive income: it’s not just about money. It’s about creating the freedom to live with less stress, more choices, and greater peace of mind.